Border to Coast Pensions Partnership, the £46bn public sector pension pool, has committed £540m to six new infrastructure funds for its 11 local government pensions scheme partners.

Border to Coast has now secured £3bn of private market commitments from its Partner Funds. The six new investments are part of its second Infrastructure offering (series 1B), which received £760m of commitments from ten Partner Funds in April 2020 – 70 per cent of which is now committed.

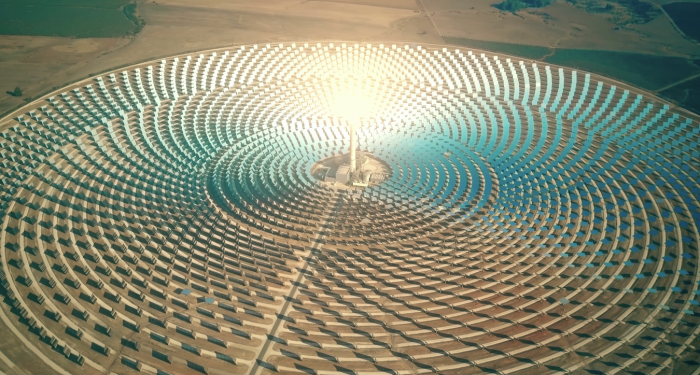

These commitments provide exposure to several of Border to Coast’s targeted themes within infrastructure including operational value add, greenfield, energy transition, digital revolution and emerging markets.

The six investments are:

Patria Infrastructure Fund IV – $100m: Patria is a Latin American specialist infrastructure manager with a strong local presence to take advantage of the significant demand for new infrastructure in the region. The manager will pursue “buy and build” and “consolidation” strategies and has extensive operational capability to drive value enhancements.

I Squared Global Infrastructure Fund III – $150m: I Squared is a global manager focused on Core+ / Value Add investments across mid-market and large cap companies. The manager has a strong global presence, with access to a team of policy advisers and extensive experience of building platform companies, particularly in renewable energy and transportation assets.

Project Ceres – £40m: This is Border to Coast’s first co-investment, a minority stake in a 39-megawatt straw-fired combined heat and power plant in Sleaford, Lincolnshire. The plant can generate electricity for 65,000 homes, saving 50,000 tonnes of CO2 per year. It also provides a market for waste straw generating additional income for local farmers.

BlackRock Global Renewable Power Fund III – $125m: The fund provides diversification across strategies (wind, solar, energy storage and distribution) and geographies (North America, Europe and Asia) with a mix of greenfield and brownfield assets. The fund also complements Border to Coast’s existing investments in renewable strategies.

Stonepeak Global Infrastructure Fund IV – $150m: Stonepeak is a North American infrastructure manager with a broad strategy across Core, Core+ and Value Add strategies. It has a strong sourcing capability as well as the ability to add value through operational improvements.

Infranode Fund II – €110m: Infranode is a Nordic manager focused on buy-and-hold investments in mid-market brownfield assets with a focus on Utilities, Renewables, Transport, Social and Digital sectors. The manager has strong relationships with local municipalities which helps to drive deal flow.

Border to Coast head of internal management Mark Lyon says: “Infrastructure is a key asset class for our Partner Funds as they seek attractive investment opportunities and diversification of risk.

“Thanks to our collective size and our inhouse expertise, we have been able to access high quality investment opportunities, including our first co-investment, whilst generating significant collective fee savings for our investors over the long term. I’d like to thank the managers involved for their constructive approach throughout the investment process as we continue to operate during the coronavirus pandemic.”

The post Border to Coast invests in six infrastructure funds appeared first on Corporate Adviser.