SPONSORED CONTENT

We’re all aware by now of the huge pressure put on workers since the UK was first plunged into lockdown in March last year, from a combination of job insecurity, separation from loved ones and an ever-present fear of contracting Covid-19.

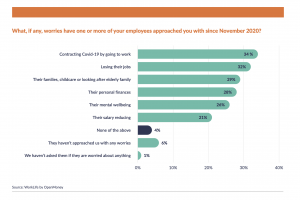

According to our latest Small Business Monitor research, some 90 per cent of firms say they’ve been approached by employees with worries lately, with concerns around losing their jobs (32 per cent), their personal finances (28 per cent) and their mental wellbeing (26 per cent) high on the list.

While the end of the lockdown restrictions might look to be in sight, this mental and financial strain will unfortunately linger much longer, meaning companies’ commitment to supporting employee wellbeing will be even more crucial in the months ahead.

Our study uncovered a clear and welcome commitment to helping people tackle these challenges, with wellbeing concerns interestingly outweighing financial and operational factors. Helping employees with the long-term impact on their finances and mental wellbeing (both 21 per cent) were the top concerns for businesses over the next 12 months, followed by keeping employees engaged when working remotely (20 per cent).

But while the desire to support staff and reward them for their loyalty is clear, it’s unsurprising that many firms are unsure about what to do – particularly when they are facing so much uncertainty themselves.

So, where to start?

As ever, employers should ensure they have a wellbeing strategy in place which seeks to cover the three key pillars – financial, mental and physical. Even if there’s already a strategy covering these areas, taking the time to reassess workers’ future needs and priorities is vital, as it’s more than likely certain resources could be better utilised moving forward.

It’s important to note that the support people will value the most is unlikely to be via direct and expensive remuneration, but rather embracing flexibility and understanding towards people’s work and home life.

Take financial wellbeing as an example. If a firm has had to cut hours or put a pause on pay increases, practical and low-cost features like vouchers towards someone’s weekly shop could make a real difference to someone over the long-term.

Benefits like free financial advice are increasingly featuring in flexible benefits packages too, and are a sure-fire way of helping them move in the right direction. Financial education and financial planning were gaining traction long before Covid-19, but they’ll become particularly powerful tools in the wellbeing toolkit as we move forward.

From a mental wellbeing point of view, when we finally return to some form of normality, a lot of people will be needing to address the impact of the pandemic on their mental health, and this calls for a much more proactive stance from employers.

At a base level, employees should be able to access wellbeing applications, ideally designed by NHS practitioners and which provide practical guidance on techniques to manage areas such as stress and sleep improvement. Such tools can be an effective and cost-efficient means of helping employees handle concerns around their mental health, but the added layer of control and confidentiality can encourage those who may otherwise not have sought help to do so.

At a base level, employees should be able to access wellbeing applications, ideally designed by NHS practitioners and which provide practical guidance on techniques to manage areas such as stress and sleep improvement. Such tools can be an effective and cost-efficient means of helping employees handle concerns around their mental health, but the added layer of control and confidentiality can encourage those who may otherwise not have sought help to do so.

Above all else, there should be a mechanism whereby employees can seek confidential help if needed. Be it through an Employee Assistance Programme or a mental health first aider, the key will be in creating a way for workers to have open and honest conversations about any worries that arise as they adjust to the ‘new normal’.

When it comes to physical wellbeing, many firms are asking employees to begin working remotely more permanently, and how they manage this transition will be crucial – particularly with those individuals who may have struggled to maintain a positive work-life balance.

Simple as it may sound, the first priority should be ensuring line managers are checking in with those who appear to be online later than others as they might need a nudge towards taking a break or getting out for a quick stroll. In the long run, companies will get much more out of an employee who is in good physical health and isn’t suffering from burnout.

It could also be worth tweaking benefits to suit those who may have developed a liking for home workouts, such as discounted equipment or online fitness programmes.

Firms have been presented with a prime opportunity to tighten the bond with the people that have kept them going during a tough year, bringing together trust and a drive to strengthen the business. Showing staff how much they mean by providing carefully considered support is the best way to cement that long-term relationship and ensure they are fully equipped to manage the road ahead.

TO VIEW A PDF OF THE WORKLIFE FROM OPENMONEY ROUND TABLE ON SIGNPOSTING, CLICK HERE

The post Steve Bee: How SMEs can support employees through the long-term effects of the pandemic appeared first on Corporate Adviser.