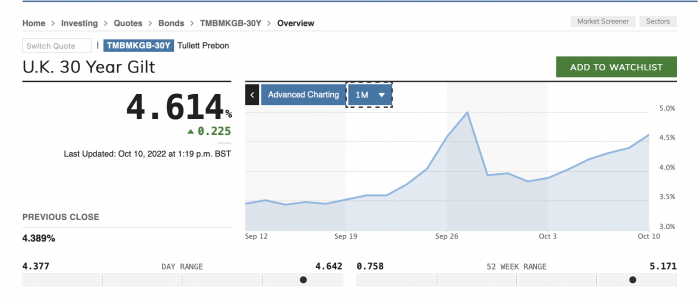

Gilt rates are heading back towards the level they were at on 27th September when the Bank of England announced a £65bn purchase programme to stop a feedback loop-driven market meltdown.

Thirty year gilt yields have increased steadily, regaining more than half the reduction in yield the BoE’s suppression measures resulted in. Today 30-year gilts yield 4.615 per cent, close to the 5 per cent level reached on 27 September, a level the BoE said placed a significant proportion of £1 trillion of DB schemes on course to insolvency.

In a letter to MPs last week the BoE said without its intervention to buy £65bn of long-dated Gilts, funds would have gone bust.

The measures are set to end on 14th October, putting pressure on the Government to publish more details of its tax-cutting fiscal plan.

Advisers say new measures to help the LDI market weather the storm are welcome, but Steve Hodder, a partner at LCP says the October 14th ‘cliff edge’ may be steeper if the BoE accelerates bond buying this week.

Hodder says there is also increasing volatility in the index-linked gilt market which isn’t supported by these measures and which pension funds have a high exposure to. LCP thinks that this could be the next test for the Bank.

Hodder says: “We have been warning clients that we may be in the “eye of the storm”, with further heavy weather possible after the Bank action ends on 14 October.

“These proposals are welcome but do retain one important feature – the “cliff edge” on Friday 14 after which bond buying will stop. If the Bank actually ramps up bond buying lots this week then the cliff edge may be steeper. We do, however, appreciate the Bank’s desire to retain a firm end point, which in itself will act to put further pressure on Government and Treasury to reassure markets of their fiscal responsibility.

“The announcement of the Bank’s expanded repo facility is, on the face of it, a clever mechanism to provide more liquidity to strained investors, to lessen the need for stressed selling of sterling debt. The outstanding question is the extent by which pension schemes (particularly smaller ones) will be able to access this as its dependent on how quickly investment managers are able to set up appropriate vehicles.

“The Bank continues to only support fixed interest gilt markets through its purchasing. The index-linked gilt market has been substantially more volatile over recent days, and we suspect there could be more focus on this in the coming weeks.”

The post Concern as gilt yields edge towards Sept 27 levels appeared first on Corporate Adviser.