Growth in renewable energy projects in the US could be hit by extreme weather risk, making it hard to get insurance for these schemes.

The latest market insights report, by GCube Insurance – a leading underwriter in this sector – said the impact of extreme weather and natural disasters was outpacing the developing of mitigation strategies in the North American market.

It said this could impact further growth, potentially offsetting the huge potential investment into this area, via the US Inflation Reduction Act.

The report shows that US renewables market has just experienced its worst summer on record for national catastrophe claims, with unmodelled extreme weather events proving far more prevalent and damaging than other disasters. It says damage from hailstorms in particular has proved costly, with losses caused by these conditions projected to reach $300m in Texas alone this year – almost 10 times the estimated losses from 2020’s Hurricane Hanna.

While total claims values are still being calculated, multiple instances of losses exceeding sub-limits of up to $50 million, due to extreme weather events like hail, tornados, and derechos, means there is a clear need for improved modelling and the more effective use of existing weather data, according to this report.

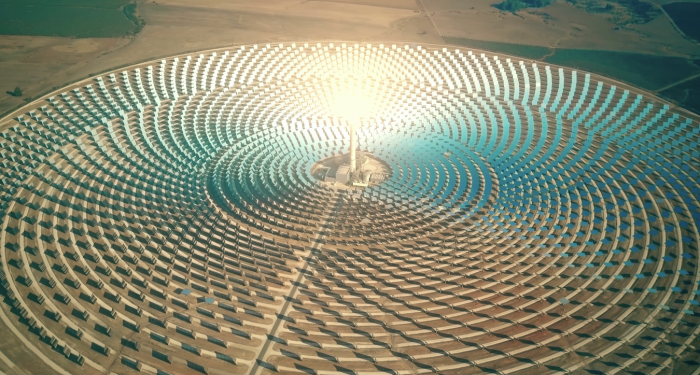

Solar technologies, for example, have proven particularly vulnerable to hail, exposing weaknesses in the sector’s current standards of impact testing.

Speaking at GCube’s annual advisory council meeting in September, leaders from the US renewable energy insurance market highlighted concerns around the ‘perfect storm’ of issues that are exacerbating the total cost of national catastrophe claims. The supply chain challenge in particular is keenly felt in the US market, with significant financial implications tied to increased downtime and component costs.

GCube CEO Fraser McLachlan said: “While the increasing frequency of extreme weather and national catastrophe events is not surprising to us, the rising severity of losses, and the industry’s continued difficulty in managing these risks, is a concerning trend.

“The unprecedented growth potential unlocked by the Inflation Reduction Act will count for little if the North American renewables sector is unable to combat Extreme weather risks.

“Concerted effort is needed across the value chain to strengthen policies, improve data utilisation, and update modelling and testing procedures, and support sustainable growth for the sector. Our latest report issues a clear call for collaboration in the US renewables industry to develop measures to combat the fallout of extreme weather, and support a stable, successful energy transition.”

The post Growth in renewable energy projects could be hit by ‘extreme weather’ events appeared first on Corporate Adviser.