First, let me point out the obvious. We’re a pension provider and so the last thing I’m going to do is downplay the importance of saving for retirement. On the contrary, pensions are critical BUT on their own do they still fit the bill?

With the ongoing cost-of-living crisis and now the UK facing what the Bank of England has warned is likely to be the longest recession since records began over a century ago, financial resilience is the new buzzword in HR circles.

Employers need to get employees more financially resilient so that they can better withstand and cope with any future financial challenges. Because as sure as eggs are eggs, there will be similar circumstances in the years to come and effectively handling these boils down to adequate accessible savings levels, which at the moment, according to the latest ONS figures, are heading for an historical low.

And why is this an employer problem and what’s it got to do with us in the pensions industry?

For an employer, it’s about employee productivity levels which ultimately negatively impacts on the bottom line. An employee arrives for work as their whole self. It’s difficult, if not impossible, to leave something of who we are at home, including the ill effects of lack of sleep due to financial worries. Minds consumed with worry are a breeding ground for bad mental health and our mental health affects our performance at work.

Employers understand this; from our own research, we found that more than 9 in 10 employers agree that financial concerns have a negative impact on employees’ mental health and a similar number believe they have a negative impact on performance levels.

Employers understand this; from our own research, we found that more than 9 in 10 employers agree that financial concerns have a negative impact on employees’ mental health and a similar number believe they have a negative impact on performance levels.

And for us in the pensions industry, it’s about making sure that whilst people are worried about today’s finances, they continue to have an eye on the future

or otherwise we risk a pensions crisis in years to come. And perhaps more importantly, we make sure that people don’t do anything without understanding the full implications of any action, especially reducing or ceasing pension contributions.

Although the number of employees currently opting-out of pensions schemes is relatively low – with Cushon research showing just one in ten (11%) are considering doing this – the risk is that people will increasingly be forced to cut pension contributions as increased living costs continue to be felt. And so,

we have to do whatever we can to at least make sure that this is an option of last resort!

How do we ensure this?

There’s making sure that we deliver appropriate financial education – by appropriate I mean both content and timing. Perhaps not surprisingly, our most popular webinars at the moment delivered by our financial education arm, Better with Money, are ‘Managing the Cost-of-Living Increase’ and ‘How to be Financially Resilient’ – both touch on pensions but more importantly they educate on day-to-day financial issues and show pensions in the context of someone’s entire financial landscape.

But it’s also about offering practical solutions. This is where the focus has to be much wider than pensions and needs us to encourage employers to do a little more “thinking outside of the box”.

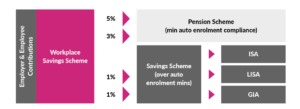

Pension Redirect is a concept that is now of real interest to employers as it not only ensures that employees are saving for retirement, but it also provides a solution to helping employees to become more financially resilient. It creates a balance between supporting employees with their long-term financial challenges as well as addressing their more immediate needs.

It recognises that employees do have other financial needs and it puts them more in control. Also, with shorter term needs being addressed, it reduces or even negates the need for employees having to think about opting out of pensions.

Perhaps the newest concept on the block is auto enrolment into workplace savings. If it works for pensions, it can work for workplace savings. You can read more about this and the work we have been doing with our friends at the University of Lincoln in our latest whitepaper: Building the financial resilience of the UK workforce.

Pensions remain critical, but we need to understand that employees have other financial challenges and it’s incumbent on us as an industry to support them.

The post Steve Watson: The future of pensions? It can’t just be about pensions appeared first on Corporate Adviser.