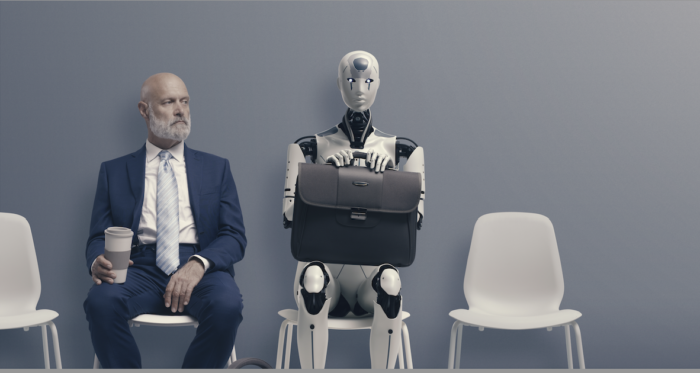

The Association of Consulting Actuaries (ACA) has established an industry group to assess the risks and opportunities of artificial intelligence (AI) to the actuarial sector.

With AI developing rapidly, the AI steering group has been established to consider how consulting actuaries should respond to the emerging challenges and opportunities that AI technology presents. The group will also be helping to develop ethical standards.

The acceleration of adoption of AI technology has been rapid, with ChatGPT, the most prominent generative AI tool, only launching in November 2022 and achieving over 100 million users in eight months. Predictions as to the scope of adoption of AI and its ability to replace roles currently delivered by humans vary widely, as do its potential influence on roles within the actuarial profession. AI also raises questions around ownership of intellectual property, as highlighted by the recent law suit issued by the New York Times against OpenAI and Microsoft over AI’s use of what it says is copyrighted content.

The industry group will be chaired by LCP Partner Alex Waite and current members include Aon, Barnett Waddingham, Buck (a Gallagher company), Isio, Mercer, and XPS.

Alex Waite, AI Steering Group chair says: “AI and how it’s used is growing and changing daily. Opinion is divided on how AI will evolve our roles and ultimately our society. Regardless, it is clear that it is here to stay and as an industry we need to respond to these changes. There are clearly many benefits that AI has that will make our jobs more efficient and help us to deliver better results for our clients.

“The aim of this group will be to help consulting actuaries better understand the impact of AI on our work and to develop some ethical standards to help us all navigate this new and emerging field.”

The post ACA establishes AI steering group to assess threats to actuarial profession appeared first on Corporate Adviser.