Aproactive approach to managing absence can significantly reduce associated costs as well as the length of time employees are off work. But, while there are plenty of ways to provide this support, the key is to get in early.

Although there’s little that can be done with short-term illnesses such as the odd sniffle or a stomach bug, Katharine Moxham, spokesperson for Group Risk Development (Grid), says that most conditions benefit from early intervention. “It can be particularly effective for mental health and musculoskeletal problems,” she explains. “But, even with conditions such as cancer or a broken leg, where employers may feel they should hang back and let the NHS look after the employee, it’s still worth keeping in touch and highlighting support such as employee assistance programmes (EAPs), nurse support and second medical opinion services.”

Benefits of being early

As well as showing an employee that the organisation cares, long- term absence can be a test in itself. “You can never predict how someone with deal with it,” adds Moxham. “The longer someone is off, the harder it can become to get them back to work.”

Over time, an employee can develop additional conditions, mental or physical, and it also becomes much more difficult to address the underlying cause of the absence. “The key is to get in early and get in quick,” says Paul Avis, marketing director at Canada Life Group Insurance, pointing to some of the mental health absences his firm has dealt with as an example. “Often there isn’t a clinical cause, it’s down to a problem in the workplace such as over promotion, conflict or performance management issues. Finding out what the issue is early makes it much easier to address it quickly and keep the employee in work.”

Alongside improved outcomes for both the employee and the employer, taking a proactive approach also delivers financial benefits. Charles Alberts, head of health management at Aon, says the earlier there’s an intervention for a health issue, the less severe it will be. “It can mean less intensive treatment, shorter recovery periods, less time off work,” he says. “It will also mean lower private healthcare costs, especially for conditions such as cancer, mental health and musculoskeletal disorders.”

Building a strategy

A variety of different tools and employee benefits can support an early intervention strategy. Alberts says that some of the most effective include EAPs, medical insurance, private GP services, occupational health and vocational rehabilitation. “More recently we’re also seen a number of new app-based solutions, especially for mental health and musculoskeletal disorders,” he adds. “All of these services remove barriers to care and encourage employees to reach out proactively.”

With so many support mechanisms in place, effective communications are another key component of an early intervention strategy. David Williams, head of group risk at Towergate Health & Protection, says employers have to make sure employees know what’s available. “Bang the drum as much and as often as you can,” he says. “Workforces are so much more broken up now that you can’t rely on a poster on the canteen wall anymore. In this environment, apps and online benefit platforms are rapidly becoming the way to promote these services to employees.”

As well as stepping in when an employee goes off sick, there’s also an argument that early intervention support should start long before this point. “Encouraging employees to eat healthily or take a bit more exercise is really positive,” explains Williams. “As well as helping them lead healthier lifestyles it also sends out a positive message about the organisation’s approach to keeping employees fit and well. This can make it much easier to promote an early intervention strategy if someone does become unwell.”

As well as stepping in when an employee goes off sick, there’s also an argument that early intervention support should start long before this point. “Encouraging employees to eat healthily or take a bit more exercise is really positive,” explains Williams. “As well as helping them lead healthier lifestyles it also sends out a positive message about the organisation’s approach to keeping employees fit and well. This can make it much easier to promote an early intervention strategy if someone does become unwell.”

Many of the medical insurance and cash plan providers have extended their products into these areas. For example, according to this year’s Workplace Protection & Wellbeing Report from Corporate Adviser Intelligence, all of the medical insurers offer a virtual GP service with many partnering with the likes of Babylon, Square Health and Doctor Care Anywhere. Services such as online health and wellbeing services, which are increasingly offered on apps; counselling support and EAPs; and discounts on gym memberships and health screenings are also commonplace.

Readymade solution

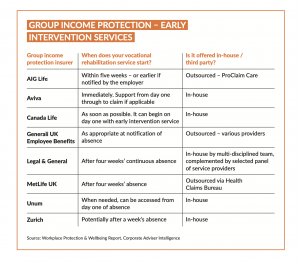

While it’s possible to source the separate components of an early intervention service independently and from healthcare benefits that are already in place, the value of this approach strengthens the argument for group income protection (GIP).

Moxham says that putting together a package of support that delivers the same early intervention service that’s available on GIP can be costly, in terms of time and outcome as well as financially. “Unless you source everything from the same provider, it’s difficult to offer a truly integrated service. The employer might find themselves having to get more involved to coordinate different elements,” she adds. “With GIP, a case manager plays a pivotal role, liaising with stakeholders including the employee, their line manager, HR function, business owner and support services to focus on a healthy return to work.”

The cost of cover also adds to GIP’s appeal. Avis says that a two-year limited term would cost, on average, between 0.1 and 0.3 per cent of salary with some organisations paying even less. “Even if an employer goes for cover with a lower benefit, they would still receive the full range of vocational rehabilitation and support services,” he adds.

The insurers also have an impressive track record in helping employees back to work. Grid’s 2020 Claims Survey found that 3,415 employees – more than a third (34.7 per cent) of all claims submitted – were helped back to work before the end of the deferred period in 2019. In addition, a further 1,833 employees whose claims started in 2018, were supported back to work.

Making it work

But whether an organisation opts for a ready made solution through a GIP plan or they build their own early intervention package, Williams says it’s essential to look at all the different services from the top down. “The emergence of all these different health and wellbeing tools means that duplication across an organisation’s benefits package is common,” he explains. “It’s sensible to consider which are the most effective and ensure that employees are signposted to these. If there are two versions available, it can be confusing and won’t enable an integrated approach.”

Moxham agrees. She recommends that employers familiarise themselves with their early intervention services. “These services take time to bed in,” she explains. “Employers should spend some time making relationships with the providers, whether it’s an insurer or a number of separate companies. This will ensure that they, and their employees, get the most out of them.”

The post Analysis: Early intervention – how insured solutions can help appeared first on Corporate Adviser.