The industry has given a cautious welcome to Government plans to divert pension funds into green projects to help meet the country’s net zero target.

Reports have indicated that the government will shortly hosting meetings with those from the pension and insurance industry as to how to implement this initiative.

However it remains unclear how advanced these plans are, with little indication of when these meetings will be, and whether concrete proposals will be in place ahead of the COP-26 climate summit taking place in Glasgow in November.

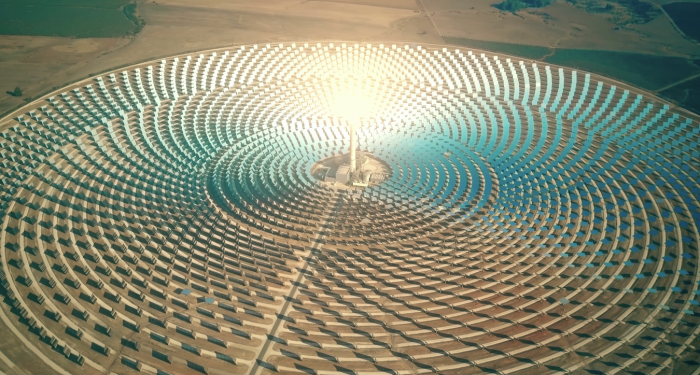

Reports have said these meeting will include in-depth discussions as to how pension assets, including money invested in workplace pensions can be diverted into initiatives such as installing solar panels in homes and providing charging points for electric cars. There are concerns though about the liquidity of funds used for in these investments and what the likely long-term return will on many of these green projects.

Helen Morrissey, senior pensions and retirement analyst at Hargreaves Lansdown says: “There will undoubtedly be interest from pension savers in investing in such projects, particularly if they support their values of developing a greener future. While challenges, predominantly around cost do exist, it is positive these discussions are happening.

“However, we are talking about the retirement savings of millions of people here and providers and trustees will need to be convinced that these investments really can add value to their members and boost their long-term retirement prospects.”

The post ‘Cautious welcome’ on Govt plans to divert pension assets into green projects appeared first on Corporate Adviser.