SPONSORED CONTENT

The UK financial landscape has changed greatly in 2022. The majority (71%) of people have a more cautious attitude towards their finances due to the current cost of living.

One-in-four people find their current financial situation difficult, and around half of people are cutting back on everyday spending.

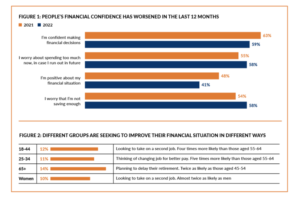

Fewer people feel confident making financial decisions, while more people worry about running out of money (see Figure 1).

These findings are from Standard Life’s Retirement Voice 2022 study, in which we surveyed approximately 6,000 people, who were representative of the UK adult population.1

Higher household bills are also much more of a concern: 43% of people worry that they will have higher household bills during retirement – up from 27% in 2021. This concern has increased even more among retirees.

The figures reflect the mood of the nation before the government’s ill-fated mini-budget in September. Given the significant market turbulence we’ve seen since, people’s financial anxieties may well have worsened.

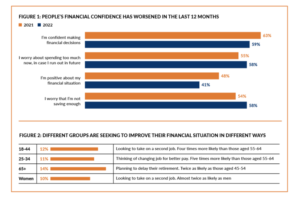

The ability to make ends meet is a significant challenge for many people. One in five say they are actively looking for ways to increase or supplement their regular income.

The ability to make ends meet is a significant challenge for many people. One in five say they are actively looking for ways to increase or supplement their regular income.

More people are searching for second jobs or putting the brakes on their retirement plans. Meanwhile, almost a quarter of people aged over 65 have returned to work after having retired.

As people hunt for cost savings, they’re more likely to stop or reduce regular payments towards TV subscriptions, phone contracts and even charity donations before they’d consider adjusting how much they save into their pension.

This could point towards people focusing on adjusting their short-term living standards, before contemplating actions that could affect their long-term financial future.

Financial planning

As winter approaches and prices continue to rise, many people may feel the effects of the cost-of-living crisis even more in the coming months.

The pensions industry therefore needs to help more people engage with their finances – and make informed choices.

Two-thirds of those who spend time planning their finances say they’re “very much” enjoying retirement, compared to just over a third of those who do little or no planning.

Yet 73% of people do little or no planning on how much money they’ll need to live on in retirement.

Many people might feel like they don’t know where to begin. For example, half of people say they find the amount of retirement planning information overwhelming. And many people say they have no idea what to do with all the information they have.

This indicates that more effective and readily available financial education could greatly boost many people’s financial planning and overall financial wellness.

With more people likely to feel vulnerable and overwhelmed by financial concerns in the months ahead, arguably the need for plain, simple communication is more vital than ever.

Supporting vulnerable people

So what else can we do practically to support people who may feel more vulnerable? Understanding that vulnerability comes in many different shapes and sizes is vital. And when engaging with people on a personal level, our choice of language can make a big difference.

People generally don’t accept and reveal their ‘vulnerabilities’ lightly. Although many people at some point feel vulnerable, most wouldn’t use that word to describe themselves.

But many people do associate with the FCA’s drivers of vulnerability – health, life events, financial resilience and financial capability. So framing challenging circumstances around these four drivers may help people to recognise their vulnerabilities, accept the difficulties of their current situation and reach out for help.

Contacting someone to communicate a change in circumstances and requesting assistance is a big step for many. So people need reassurance that they won’t be judged, and know that they’ll receive support if they do reach out. And, of course, receiving empathy is vital.

There are a lot of broad societal drivers of vulnerability, and as an industry we can’t tackle all of them. However, we can help to level the playing field for consumers by:

Designing inclusively

Ensuring diversity of thought/input from diverse customer voices

Supporting colleagues to respond compassionately and empowering them to

tailor the approach depending on the vulnerability driver

Fostering a customer-obsessed, excellent experience culture

To find out how Standard Life is helping employees, visit our Vulnerable Customers Policy and Helping Hand Programme.

The post Gail Izat: Why many of us may be feeling more vulnerable appeared first on Corporate Adviser.