A raft of A-list celebrities including Gary Lineker, Graham Norton, Westworld star Thandie Newton, and Mariella Frostrup have backed a campaign calling for greener and more ethical pensions.

The string of celebrity backers for the Make My Money Matter campaign, launched last week by screenwriter and film director Richard Curtis, co-founder of Comic Relief, with former Bank of England governor Mark Carney, marks arguably the highest-profile campaign on responsible investment issues to date.

Curtis’s wife, Emma Freud, received support on Twitter from a host of media figures including BBC Radio DJs Simon Mayo and Jeremy Vine, interior designer Kelly Hoppen and comedian Sally Phillips.

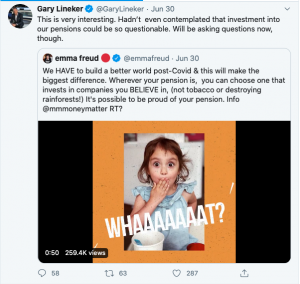

Lineker tweeted to his 8 million followers ‘hadn’t even contemplated that investment into our pensions could be so questionable. Will be asking questions now, though’.

The initiative is calling on the pensions industry to commit to net-zero carbon emissions by 2050, and for the Government to require, in the forthcoming Pensions Bill, that pension funds report on their emissions projections to 2050 and their alignment to the Paris Climate Agreement

Make My Money Matter CEO Tony says a key plank of the organisation’s strategy is to target key influencers through social media.

Burdon says: “There are digital influencers out there on social media all saying which brands they know they won’t be buying from in future. When people realise where their pensions are invested, they are going to want to change provider.

“In the future you will be able to have an app that will tell you how your pension is invested, and the extent to which it is aligned with the UN’s principles of responsible investment.

“Our strategy is to engage with the public in a fun way, and also engage with businesses and NGOs and ask them to become partners.”

Barnett Waddingham partner Mark Futcher says: “Pension funds and the asset owners will only change if there is real demand and engagement – it is great to see campaigns like this which raise the awareness amongst the general public. Most of the public will have concerns but probably felt there was little they can do. Pension schemes being long term investments are likely to be more adversely impacted by the impact of climate change and pressuring companies into making changes will benefit everyone.”

Capital Cranfield trustee Andy Cheseldine, chair of trustees of Smart Pension, says: “It is great to get people more interested and engaged with their pensions. My job is not to listen to this, it’s to achieve the best returns for the members. Smart is targeting 70 per cent ESG within a year – that is because we think it makes good financial sense, not because we are cuddly. We can’t dictate to members what ethical choices they should make.

“There are plenty of arguments to say oil and gas valuations will be lower in future. That is a financial decision rather than a social one.

“Self-select ethical options should be made more widely available. But there is a wide range of what people see as ethical. It is really difficult to achieve within the default.”

The post Lineker leads celeb backing RI pension campaign appeared first on Corporate Adviser.