Few would challenge the importance of member engagement and retirement adequacy – it’s the focus of the industry at large. In fact, the desire to help people better manage their money underpins our passion for what we do. But driving higher levels of engagement is easier said than done. At HL Workplace, it’s an ongoing priority. This focus has culminated in developing our industry-leading Engagement Dashboard.

The Engagement Dashboard

The Dashboard is designed to give scheme-level visibility of member engagement, with a comparison to the previous year and sector benchmarks.

We focus on seven measurable member actions that apply to all age groups.

The aim of the Dashboard is to make it easy to identify engagement gaps and subsequently deploy a multichannel strategy that drives results.

A case study

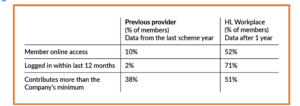

Last year, we won the workplace pension of one of the largest worldwide charities. We have some corresponding engagement data from their previous provider to compare with ours – see the before and after below.

It’s evident that moving to HL Workplace is a game-changer for engagement and better member outcomes.

How do we achieve these results?

Like with most things, there are multiple factors at play that, when combined, make a huge difference. Our multi-channel approach includes:

personal, bespoke scheme-level education (by the adviser or HL). This usually includes one-to-ones and presentations (both onsite and remote), monthly newsletters and sessions on a variety of financial wellbeing topics

personal, bespoke scheme-level education (by the adviser or HL). This usually includes one-to-ones and presentations (both onsite and remote), monthly newsletters and sessions on a variety of financial wellbeing topics

a wider savings solution that caters for all ages and life stages

a wider savings solution that caters for all ages and life stages

creating relevant, segmented and bespoke communications for the employer to send to employees

creating relevant, segmented and bespoke communications for the employer to send to employees

making it simple and easy for members to implement action through our app, online or calling our helpdesk

making it simple and easy for members to implement action through our app, online or calling our helpdesk

sustained efforts to engage members on an ongoing basis.

sustained efforts to engage members on an ongoing basis.

Talking about wider savings can also help members to think about retirement savings sooner than they would have otherwise. If members start engaging with their short and medium-term finances, they’re more likely to think about their longer-term needs.

We’ve also found that the newer a member is to HL, the more likely they are to engage with us. So producing targeted communications for new members is key.

And if we’re providing one-to-ones (at the discretion of the adviser), we know that 63 per cent of members who had a one-to-one decided to increase their contributions, compared to 38 per cent of those who didn’t have a personal meeting. Our data shows that one-to-ones are integral in moving the dial for better retirement outcomes.

It’s also important to consider when not to contact a member. Sending too much information puts people off, especially if it’s not relevant.

We have a great track record of moving the dial and striving for better member outcomes. There’s still more work to do, but it’s clear that a consistently bespoke service and personal touch drives great results.

The post Pension engagement isn’t an added bonus – it’s crucial appeared first on Corporate Adviser.