Some people still talk about “the” pensions dashboard. My 2023 research tour showed that’s wrong. Sure, the Government is making a dashboard available through its MoneyHelper brand at the Money & Pensions Service (MaPS). And it’s right that there should be a pensions dashboard universally available.

But my independent research visit to the NorskPensjon team in Oslo in June 2023 demonstrated more clearly than ever that it’s commercial dashboards where the vast majority of the action is going to be.

There are (at least) five clear advantages of commercial pensions dashboards, all spookily beginning with the letter A. Shadow Ministers now recognise these benefits too, as the Hansard quotes below reveal.

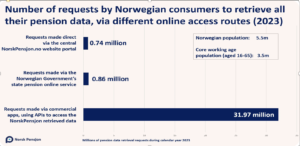

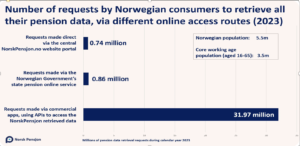

Advantage one is access. The most obvious advantage is that commercial dashboards make the Government’s secure central data retrieval service (from PDP) available in many different places: which was exactly Norway’s experience. The central NorskPensjon data retrieval service was originally established with just its own consumer front-end portal. Then NorskPensjon was also made available on the Government’s state pension online service, enabling Norwegians to see their workplace and private pensions alongside their state pension.

But the real uptick in usage came when the NorskPensjon pension data retrieval service was made available to commercial apps, like banking and pension apps. In 2023 the Norwegian system saw 32m data requests via commercial apps, compared to less than a million via the central NorskPensjon.no portal, and a similar figure through the government’s state pension online service.

The Labour Party really understands this point. Shadow Economic Secretary to the Treasury Tulip Siddiq said in Parliament last week: “International evidence shows that to reach their potential to help millions of people, dashboards must be incorporated into services that people already use”.It’s why Standard Life says they will put a commercial dashboard in their existing app. Expect many more announcements of commercial dashboards to follow from pension providers, master trusts, and banks.

The second advantage is ‘audit’. The legislative name for a commercial dashboard is a Qualifying Pensions Dashboard Service (QPDS). There are lots of regulatory requirements on firms who want to provide a QPDS. For example, DWP Dashboards Regulation 13 requires every QPDS provider to appoint, and pay for, an independent expert auditor, who is suitably qualified or experienced, to audit their QPDS technology.

As well as independence, these statutory audits of QPDSs have both depth and longevity. Depth in that the auditor must send official reports to MaPS confirming that the QPDS they have audited complies with the full suite of PDP design, data, technical, operational and reporting standards. The audit firm will need to deploy multi-disciplinary specialist teams to provide this independent view. Longevity in that the auditor must carry out both a “Pre-connection” audit, before the QPDS is connected to the PDP Central Digital Architecture (CDA), and then Annual audits every year afterwards.

So when a consumer uses a commercial dashboard, they can be confident it has been officially and independently audited for compliance by a specialist firm within the last 12 months. QPDS providers will no doubt wish to promote this audit assurance to their users to build confidence in a given firm’s QPDS.

Authorisation is the third advantage. QPDS firms are going to be authorised and supervised by the Financial Conduct Authority (FCA).

HM Treasury legislation which makes “Operating a pensions dashboard service” a new FCA-regulated activity is making its way through Parliament right now. Once in force, it opens the way for the FCA to publish final detailed Authorisation and Conduct of Business (COB) Rules for QPDS firms. FCA will then start accepting applications from firms to become authorised as an FCA-regulated QPDS provider.

Labour is keen for this process to play out soon. In Parliament, Labour’s Tulip Siddiq asked the Government Treasury Minister Bim Afolami: “When will the FCA publish its final rules [for QPDS providers]?”

Advantage four is assets: Commercial QPDS provider Moneyhub has tested QPDS designs with a range of real consumers. Having seen the estimated total income they might get in retirement (across all their different pensions, including State Pension), a common question many consumers asked was: “Will that be enough to live on, and how does it compare to what I spend today?”

This is easily answered. If the QPDS they’re using is also Open Banking-enabled it’s incredibly easy for the user to also connect directly to their Current Account(s) for a rapid analysis and display of how much they spend today summarised across a range of different common expenditure categories.

Test participants also asked: “What else will I have to live on?” This is where Open Finance comes in. From their app, users can also directly connect things like ISAs and other investments, and even the value of their home. So a QPDS’s 4th advantage is the ability to see all Assets, including pensions, together in one place.

Again Labour likes this. Labour’s Tulip Siddiq said: “Some dashboards will present other financial data alongside pensions. That is one of the main benefits to consumers: to see all their finances in one place”.

And the fifth advantage is action. My European research tour found that, having viewed their pensions, many consumers don’t want to take action immediately, especially the younger savers. They’re happy just to look at their total pension position on a dashboard a few times a year, gradually increasing in trust and confidence.

But when consumers want to get more involved, the final great advantage of QPDSs is that the user will already be on an app where they can take next steps, such as modelling different retirement ages, considering whether to change their contributions, or exploring bringing some of their pensions together, and so on.

So what’s next? HMT’s legislation making QPDSs a new regulated activity is due to come into force in just four weeks’ time in early March, making way for FCA to publish final QPDS Rules, and then start accepting QPDS applications.

Whatever the outcome of the upcoming General Election, expect these developments to continue at pace, and expect to hear much more about commercial pensions dashboards as we progress through 2024.

The post Richard Smith: Five ‘A’ reasons why commercial pensions dashboards have strong cross-party support appeared first on Corporate Adviser.